Cutoff Optimization in KPI-COSMO: Improving Destination Decisions Under Uncertainty

But these forecasts are only as good as the resources model behind them (and geology is uncertain). Using a single and smooth estimated block model4,5 combined with fixed cutoff values hides this variability 6, leading to mine production plans that are overly optimistic or too conservative, that is, risky with high probability of not being materialized 7.

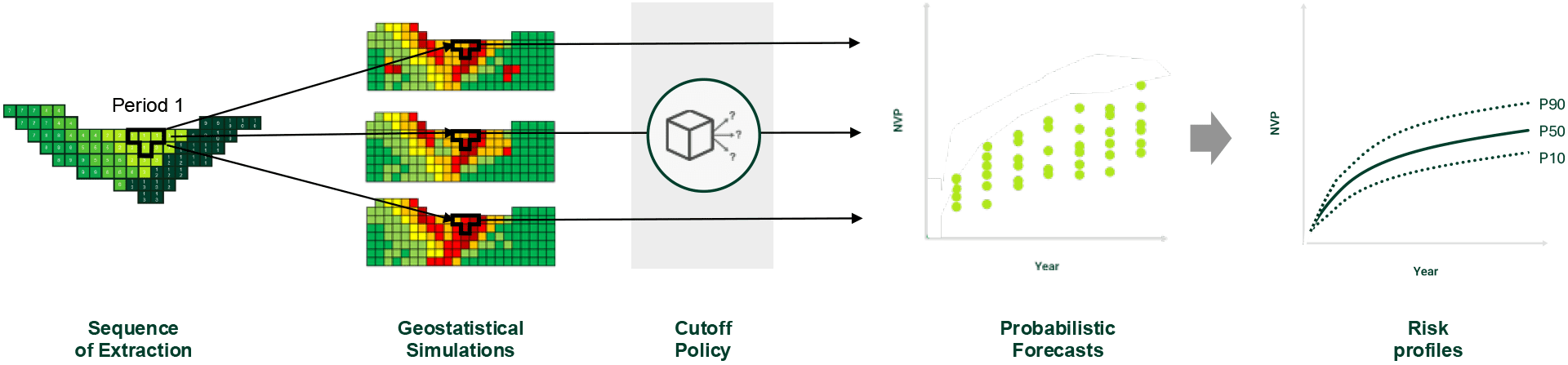

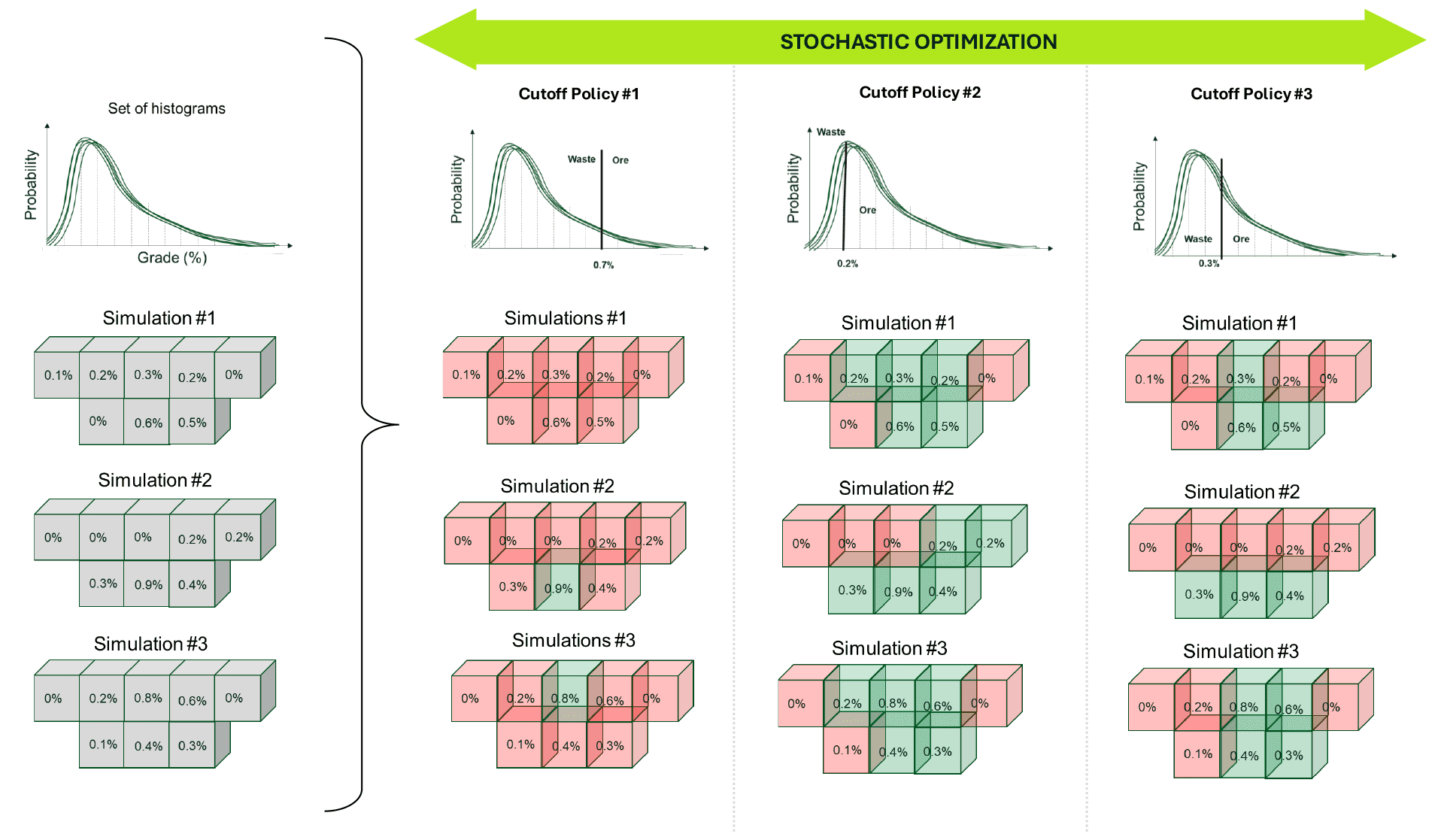

KPI-COSMO introduces a different approach: a stochastic optimization framework that directly incorporates uncertainty into the decision-making process. Instead of relying on an estimated block model and fixed cutoff grades, it searches for the optimal cutoff policy across multiple simulated versions of the deposit, aiming to maximize Net Present Value (NPV) while controlling risk 8,9.

By modeling the probability of each block being ore or waste, the optimizer produces not just a plan, but a probabilistic forecast. This reflects the deposit’s uncertainty and supports more confident strategic decisions. This means better predictions of future production, fewer surprises in execution, and improved alignment between plans and reality.

In this article, we explore how cutoff optimization under uncertainty works in KPI-COSMO and why embracing geological risk – rather than ignoring it, leads to better mine planning outcomes.

In mining, the cutoff grade is the minimum grade that defines whether a block is treated as ore or waste. But in practice, this decision is rarely constant over the life-of-mine, and it plays a central role in strategic mine planning. The choice of cutoff should be optimized since it directly affects the forecasts of ore and waste tonnages, the quality of material feed to the plant, and the Net Present Value (NPV) of the project10–12.

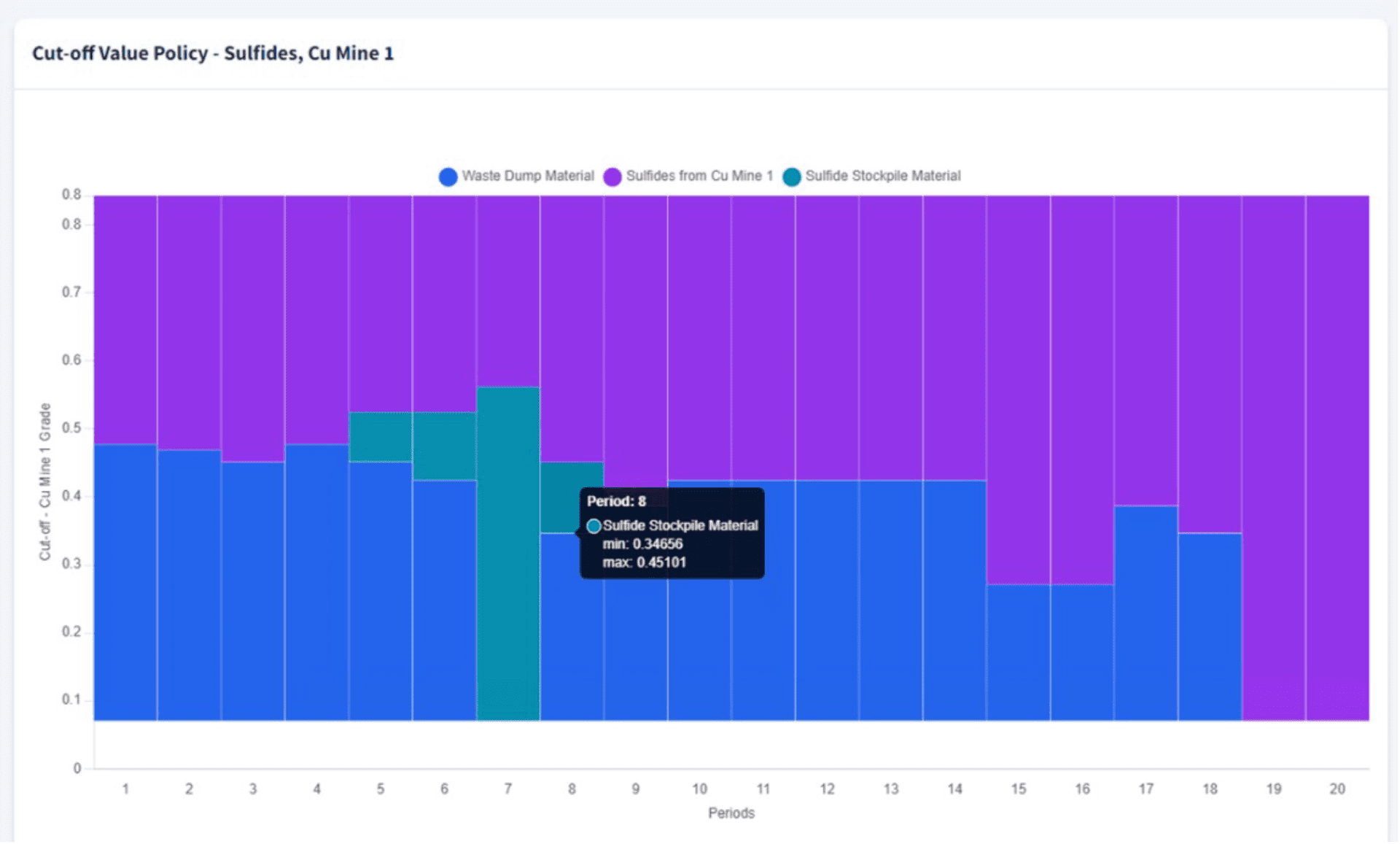

As mine planning advanced, the concept of cutoff grade shifted from a fixed threshold to a dynamic and optimized value, adapting to market prices, costs, and operational constraints. With the advent of stochastic modeling, this evolution went further: cutoff grades are no longer fixed input parameters, but variable outputs of an integrated optimization process that accounts for geological uncertainty. They emerge as strategic decision variables within the planning process itself.

At the end of the day, why do we optimize cutoffs? Because they determine how much ore we’ll produce, how much waste we’ll move, and ultimately, how much value we’ll create. A good cutoff policy maximizes NPV not by eliminating uncertainty, but by making smarter decisions under it.

But how do we do that with 50 simulations, without defining a fixed cutoff beforehand, and without scheduling over pre-defined, non-economically optimized pits and phases? That is the magic of stochastic optimization of mineral complexes.

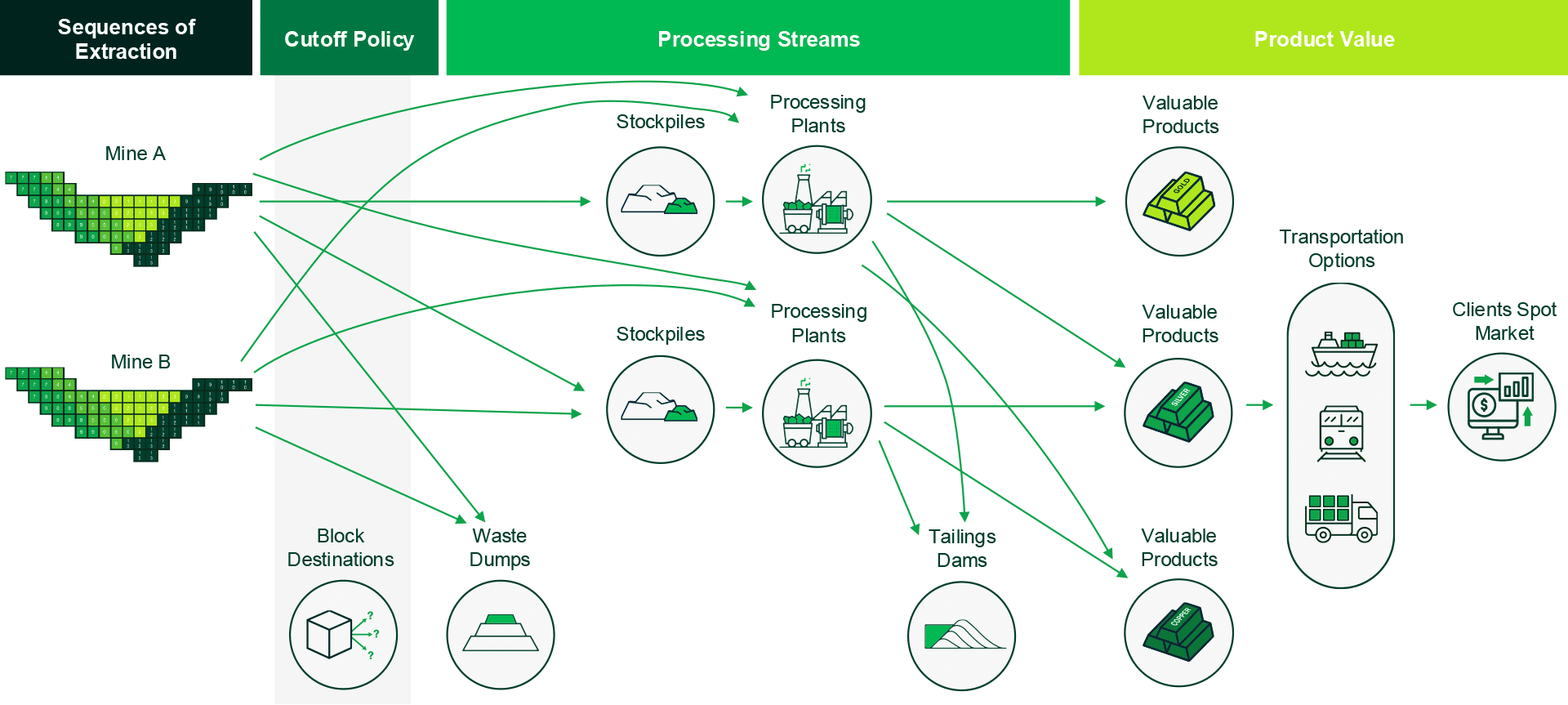

- Block sequence – When each block is mined.

- Block destination – Where each block is sent.

- Processing stream – Which flow between destinations to follow.

At the end of the optimization process, an optimal year-by-year cutoff policy is selected for each material type at each mine, so as to maximize value and manage risk for that specific context.

- Cutoff policy #1 is not selected because does not guarantee maximum NPV (few blocks to the plant).

- Cutoff policy #2 is not selected because, although it guarantees better NPV, it is generating products with low grade and exceeding the plant capacity.

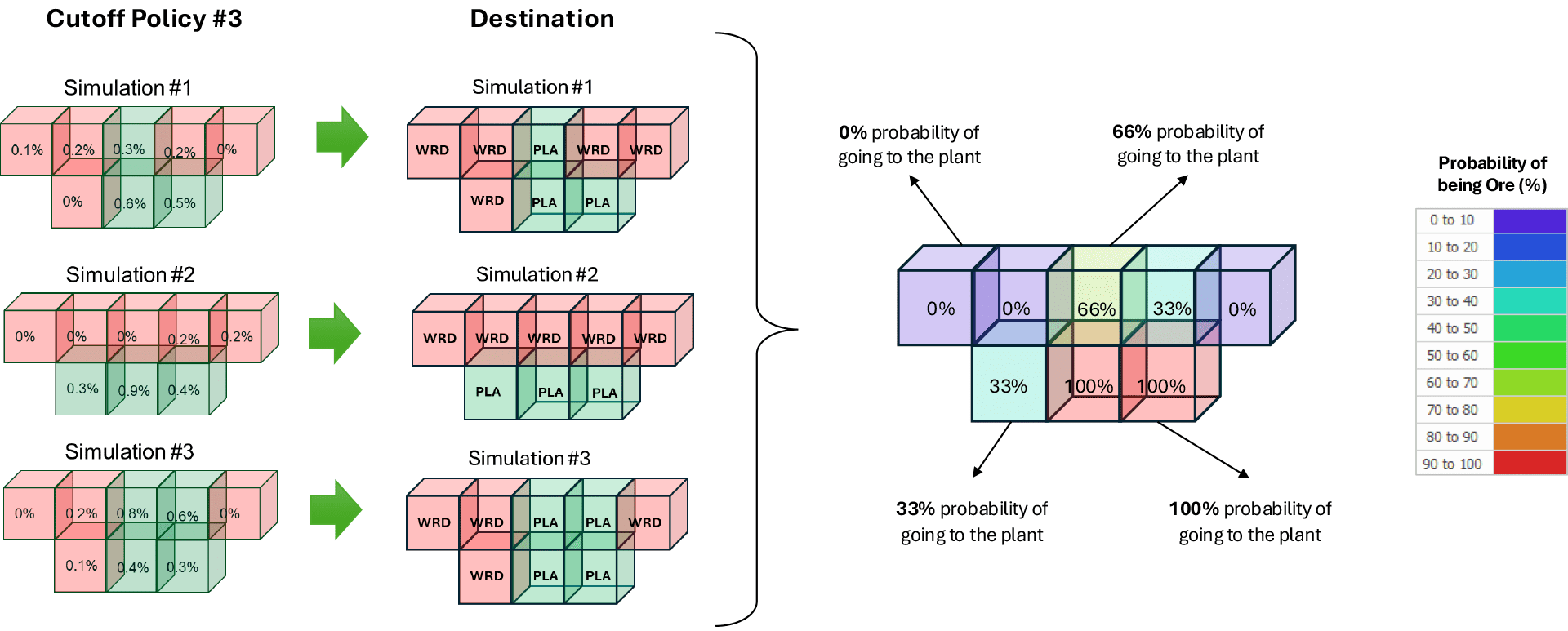

- Cutoff policy #3 is the one which maximizes NPV, generating a product with desired quality and respecting the plant capacity.

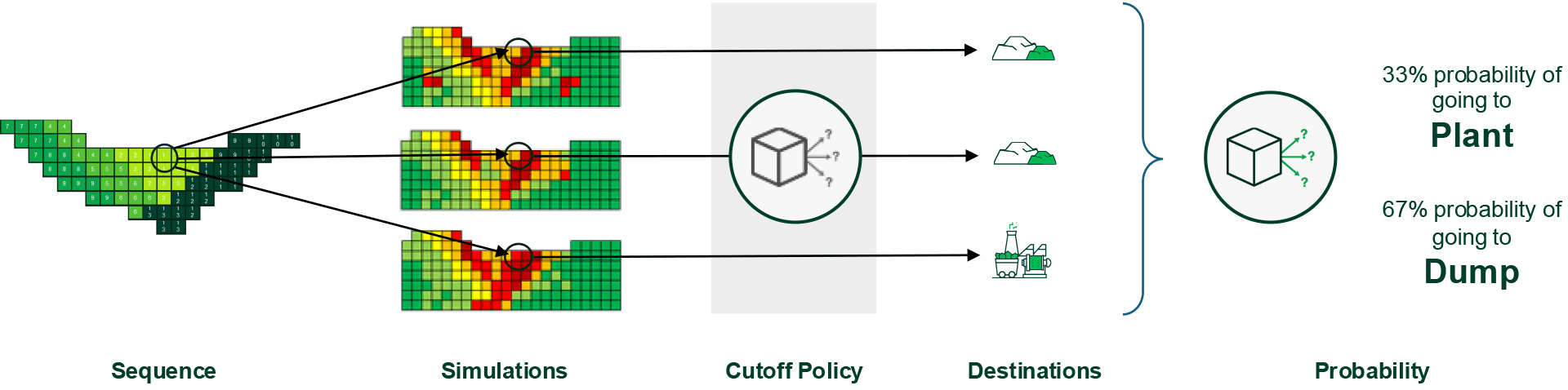

- The block in purple, in the top-left corner, has 0% chance of going to the plant – all simulations are going to the waste rock dump. This is a low-risk block.

- The block in red, in the bottom-right corner, has 100% chance of going to the plant – all simulations confirm it as ore. This is a low-risk block.

- The block in green, in the center, has a 66% chance of going to the plant under the optimized cutoff policy (0.3%) – 2 out of 3 simulations are going to the plant, and 1 to the waste rock dump. This is a high-risk block.

- The block in light blue, in the bottom-left corner, has a 33% chance of going to the plant under the optimized cutoff policy (0.3%) – only 1 of the 3 simulations sends it to the plant, while 2 send it to the dump. This is a high-risk block.

- Identify high-risk blocks near cutoff thresholds, especially in transition zones.

- Prioritize high-confidence areas, reducing reliance on stockpiles and rehandling.

- Improve plan adherence, by aligning destination choices with actual block variability.

- Support strategic decisions, such as evaluating the economic viability of processing routes and avoiding unnecessary CAPEX.

- And ultimately, proactively manage geological risk, turning uncertainty into a tool for value optimization.

- Should the company expand its high-grade processing plant capacity to accept this material?

- Is the low-grade concentration plant truly viable for processing it?

Traditionally, these questions would have been tackled using a single estimated block model and fixed cutoff values, potentially masking critical risk factors. Instead, the team deployed a fully stochastic framework that embraced uncertainty: 20 geological and grade simulations were combined with a unified optimization process, where cutoff grades were not fixed by rules but discovered as optimized outputs of the optimization.

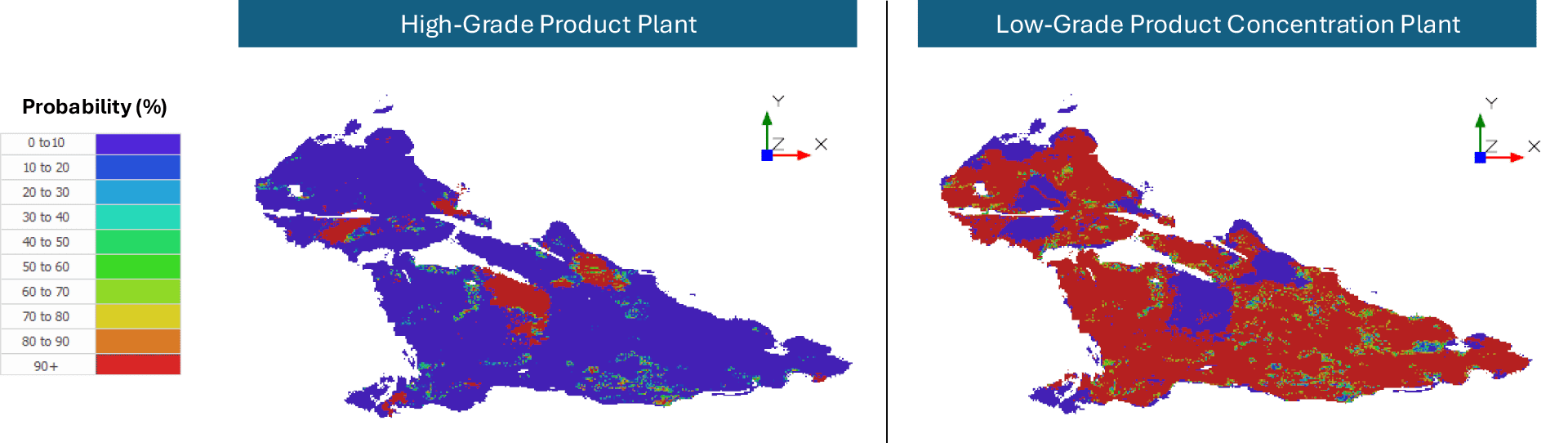

The images below show the probability maps for the evaluated material type, illustrating its probability of being routed to either the high-grade or low-grade plant.

1. No Need to Expand the High-Grade Product Plant

- Although the mine has high probability of sending blocks to this plant, the risk profiles of feed tonnages dropped significantly after the initial years in many simulations. Several scenarios resulted in early shutdown of the plant, making its expansion economically unjustifiable.

- On the other hand, as can be seen in the image, the majority of the blocks have high probability of being sent to the low-grade product concentration plant, resulting in higher overall project value.

- The optimizer considered the synergy of the plants and also the simulations of the main metal and contaminants during optimization, showing that the high-grade product plant expansion is not necessary due to quality risks and declining availability.

- The probabilistic model demonstrated that expanding this plant would lead to poor returns under uncertainty.

- As can be seen in the images, there are many blocks of the mine that have high probability of being consistently routed to these plants across all simulations.

- Probabilistic forecasts (P10, P50 and P90) showed stable and sustained throughput over the entire life-of-mine.

- Strict contaminant constraints were respected.

- Final product grades consistently met or exceeded commercial specifications.

3. Operational and Economic Benefits Beyond Processing

- A significant reduction in waste movement and in stripping ratio, over 20%, compared to the deterministic plan.

- An NPV similar to the deterministic benchmark, but without additional CAPEX and with significantly lower operational costs.

- All operational constraints — such as sinking rate and minimum mining width — were respected, confirming the plan’s practical feasibility.

- Prioritize stable, low-grade product production routes with consistent product performance.

- Avoid unnecessary investments in high-risk expansion projects.

- Use risk-informed schedules to support strategic decisions under uncertainty.

Conclusion: A Shift Toward Resilient Planning

Cutoff optimization under uncertainty, as implemented in KPI-COSMO, represents a meaningful step toward more resilient and realistic mine planning. It acknowledges geological variability, models it explicitly, and uses it to drive better decisions at every level—from strategic design to daily dispatch.

When combined with KPI-COSMO’s stochastic optimization engine, cutoff policies are no longer assumed or fixed, but they are discovered, validated, and tailored to risk. This transforms uncertainty from a planning challenge into a strategic advantage.

References

- King, B. Transparency in cut-off grade optimisation ‘Clear-cut ’. in Strategic Mine Planning Conference 26–29 (Whittle Programming Pty Ltd, 2001).

- King, B. Optimal mining principles. in Advances in applied strategic mine planning (ed. Dimitrakopoulos, R.) vol. 17 7–11 (The Australasian Institute of Mining and Metallurgy, 2018).

- Hall, B. & Stewart, C. Optimising the strategic mine plan – Methodologies, findings, successes and failures. Australas. Inst. Min. Metall. Publ. Ser. 14, 301–307 (2007).

- Goovaerts, P. Geostatistics for natural resources evaluation. (Oxford University Press, 1997).

- Journel, A. G. & Huijbregts, C. J. Mining geostatistics. (Academic Press, 1978).

- Lane, K. F. Choosing the optimum cut-off grade, Colorado School of Mines Quarterly. 59(4). (1964).

- Dimitrakopoulos, R., Farrelly, C. T. & Godoy, M. Moving forward from traditional optimization: grade uncertainty and risk effects in open-pit design. Min. Technol. 111, 82–88 (2002).

- Dimitrakopoulos, R. & Lamghari, A. Simultaneous stochastic optimization of mining complexes – mineral value chains: An overview of concepts, examples, and comparisons. Int. J. Mining, Reclam. Environ. April, 1–18 (2022).

- Goodfellow, R. C. & Dimitrakopoulos, R. Global optimization of open pit mining complexes with uncertainty. Appl. Soft Comput. J. 40, 292–304 (2016).

- Lane, K. F. The economic definition of ore – Cut-off grades in theory and practice. (COMET Strategy Pty Ltd, 1988).

- Dagdelen, K. An NPV Maximization Algorithm for Open Pit Mine Design. in Application of Computers and Operations Research in the Mineral Industry XXiV 257–263 (Canadian Institute of Mining Metallurgy and Petroleum, 1993).

- Rendu, J. M. An Introduction to Cut-Off Grade Estimation. (Society for Mining, Metallurgy and Exploration (SME), 2014).

Douglas Alegre

Douglas is a Mine Planning Consultant with extensive experience in strategic and operational planning, economic modeling, and project evaluation. He has worked across a wide range of commodities—including gold, iron ore, copper, and rare earths—supporting major mining companies throughout Brazil. He focuses on consulting, implementation, and training to help clients adopt advanced, simulation-based mine planning tools. Connect with Douglas on Linkedin.